fundamental risk affects closed end funds in which of the following ways

None of the above. Multiple Choice A stock is overpriced but your fund does not allow you to engage in short sales.

Wondering About Closed End Funds Learn A Few Basics Ticker Tape

Liquidity risk refers to how easily a company can convert its assets into cash if it needs funds.

. By accurately calculating the expected return of an asset investors will be guaranteed a strong return. This would be true in particular when fundamental risk is a substantial part of volatility. An investor can find price quotations for closed-end and open-end funds.

Closed-end funds operate more like ETFs in that they trade throughout the day on a stock exchange. A portfolios risk is measured by the degree of volatility in the portfolio. Multiple Choice A stock is overpriced but your fund does not allow you to engage in short sales.

Closed-end funds may trade at a discount or premium to their NAV and are subject to the market fluctuations of their underlying investments. Funds primarily close because the investment advisor. All bonds are subjected to _____ risk.

Ways to decrease risks include diversifying assets using prudent practices when underwriting and improving operating systems. Closed-end funds have stood the test of time for more than a century and have the potential to help savvy investors. The funds always trade at a discount from NAV.

In financial papers and at financial websites. Are closed end funds risky. A managed fund will outperform an index fund only 60 of the time.

A diverse portfolio reduces your exposure to the adverse effects of any one investment. And this was typically historically this has typically been from preferred shares. Jeff Rossi President Peak Wealth Advisors JeffRossi 072916 This.

It also refers to its daily cash flow. A benchmark of a good fund manager is the ability to increase share value when the economy is good and retain that value when the economy is bad. Prudent risk management can help banks improve profits as they sustain fewer losses on loans and investments.

_____ risk affects all stock mutual funds. Or permanent as in the case of closed end funds. CEFs are sometimes described as ancestors to exchange-traded funds but CEFs have a fixed number of shares while ETFs can raise or lower the figure as demand changes.

Closed-end funds are more likely than open-end funds to include alternative investments in their portfolios such a s futures derivatives or foreign currency. Answer Question Share 6 1. Closed-end funds have the ability to use leverage which can lead to greater risk.

Examples of closed-end funds include. A closed fund is a fund that is closed - either temporarily or permanently - to investors. A lot of the funds in the closed-end fund space use leverage.

Their yields range from 632 on average for bond CEFs to. A managed fund will outperform an index fund only 60 of the time. How does diversification reduce the risk of a financial portfolio.

Shares of closed-end funds frequently trade at a market price that is a discount to their NAV. A benchmark of a good fund manager is the ability to increase share value when the economy is good and retain that value when the economy is bad. The funds redeem shares at their net asset value.

Funds can close for various reasons. That means the CEF share. The funds offer investors professional management.

Managed funds may be open-end funds or closed-end funds. For open-end funds if a company offers several different funds. Mutual Fund Observer Morningstar and Portfolio Visualizer are used to identify lower risk mutual funds exchange traded funds and closed end funds with higher-risk adjusted returns.

Answer Question Report Abuse Share. The higher the expected return the higher the risk. When one investment is not performing well other investments may be performing well thus reducing your overall risk.

The major risks faced by banks include credit operational market and liquidity risks. Closed-end funds CEFs can be one solution with yields averaging 673. Which one of the following statements regarding closed-end mutual funds is false.

Correct End of Chapter 14 Market risk is the risk that is common to all assets of a certain type while idiosyncratic risk is the risk that pertains to a particular asset rather than to the market as a whole. Closed-end funds are subject to management fees and other expenses. Interestingly Warther 1995 also shows that fund flows in and out of mutual funds affect contemporaneous returns of securities these funds hold consistent with the results established below.

Operational risks emerge as a result of a companys regular. Managed funds may be open-end funds or closed-end funds. A portfolio is a set of multiple investments in different assets.

Which one of the following best describes fundamental risk.

Federal Register Fund Of Funds Arrangements

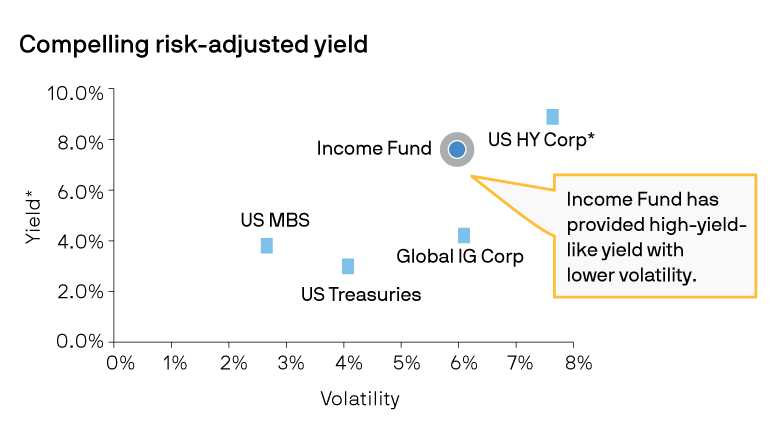

Jpmorgan Income Fund A J P Morgan Asset Management

Closed End Funds Basics How It Works Pros Cons The Smart Investor

/GettyImages-1162966566-19102c67f9424a5d9b7eb826332ed48d.jpg)

Understanding Closed End Vs Open End Funds What S The Difference

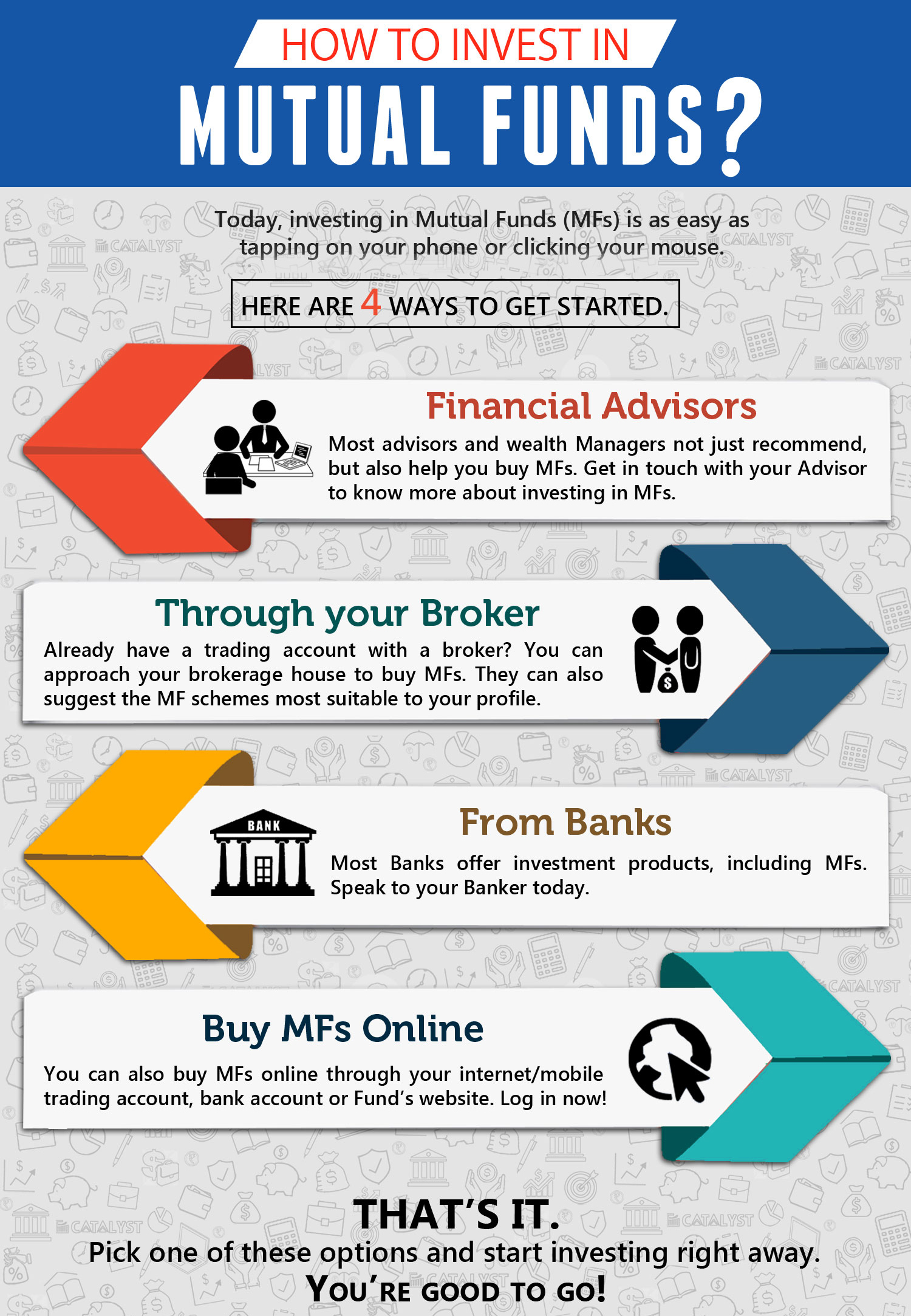

How To Invest In Mutual Funds Jamapunji

Open Ended And Evergreen Funds In Venture Capital Toptal

Federal Register Securities Offering Reform For Closed End Investment Companies

Open End Vs Closed End Mutual Funds Overview Features Performance

Closed End Funds Basics How It Works Pros Cons The Smart Investor

Closed End Fund Cef Vs Exchange Traded Fund Etf Study Com

Cef Etf Income Laboratory Marketplace Checkout Seeking Alpha

Closed End Funds Basics How It Works Pros Cons The Smart Investor

Cef Etf Income Laboratory Marketplace Checkout Seeking Alpha

/MutualFund2-0ca2ba12fdc4424cb0e4155bf9ef3c25.png)