fha gift funds limit

Gift Funds In order for funds to be considered a gift there must be no expected or implied repayment of the funds to the donor by the borrower. According to HUD 41551 Chapter Five Section B In order for funds to be considered a gift there must be no expected or implied repayment of the funds to the donor by the borrower.

Fha Loan Rules For Down Payment Gift Funds

FHA loans do not require notarization of the.

. Gifts clearly given because of a family relationship or personal friendship. First gift funds can only be used for down payments and closing costs. Gift Funds Already Received.

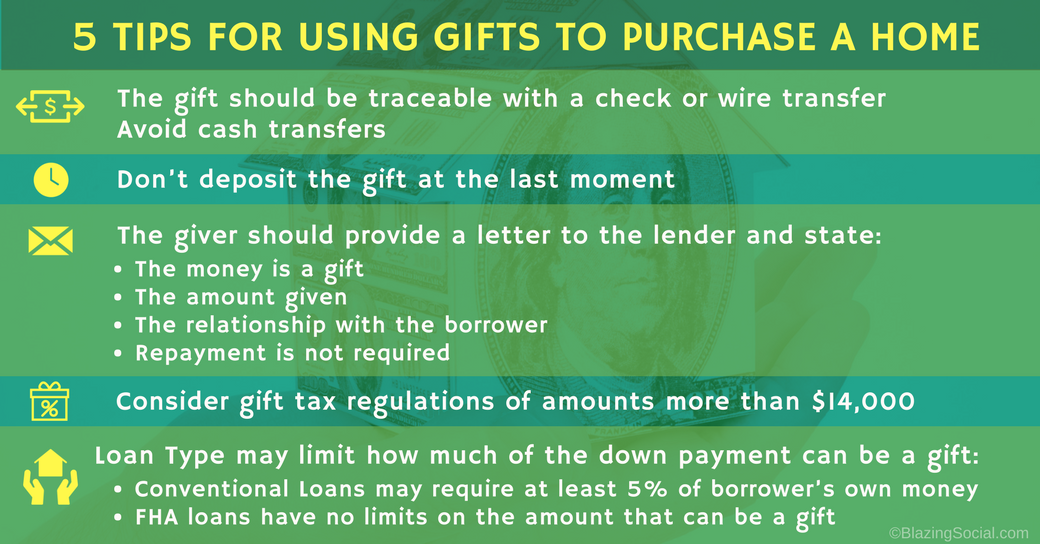

Here are some guidelines when using a gift fund for FHA. Gift funds can only be used on primary homes and second homes not investment properties. All of your down payment funds can be a gift if you put down 20 or more.

A borrower of a mortgage loan secured by a principal residence or second home may use funds received as a personal gift from an acceptable donor. This is providing the equity is enough to. Sellers Concessions-FHA mortgage requirements allow for seller concessions of up to 6 of the sales price.

FHA Guidelines On Gift Funds state that home buyers can get 100 gift funds to purchase their home. Provide executed gift letter. The new FHA Policy changes limit seller.

Wedding Gift Funds. Freddie Mac allows. According to the IRS gift tax exclusions in 2022 any down payment gift below 16000 does not have to be reported.

If youre putting down less than that part of the money can be a gift but 5 must come out of your own pocket. Conventional Loans all of your down payment may be gifted if youre putting down 20 or more. In turn parents can collectively give up to 32000 per child without needing to report those funds to the IRS.

The gifted funds must be sourced and seasoned and cannot be borrowed by the donor. The donor cannot have borrowed the gift funds thru an unsecured loan. Some of the more common exceptions to the gift prohibition allow employees to accept --Unsolicited gifts with a value of 20 or less.

Gift funds can only be used on primary residences. And the down payment is only 35. Homeowners insurance property tax escrow etc.

Seller Concessions and Reserves. The gift can come from any. Beyond that amount the funds must be reported on the donors gift tax return.

Gift Funds-Down payment funds can be gifted from a relative spouse or a domestic partner. 41551 5B4b Who May Provide a Gift An outright gift of the cash investment is acceptable if the donor. Gift of equity 35 down payment.

You have the option of paying the MIP in full at the time of closing or having it rolled into the loan. By accepting a gift of equity credit the seller is basically paying the down payment for the buyer. Both the borrowers and sellers must meet certain guidelines to participate in a gift-of-equity arrangement.

FHA loan rules in HUD 40001 have specific guidelines where gift funds to the borrower are concerned. Gift funds may fund all or part of the down payment closing costs or financial reserves subject to the minimum borrower contribution requirements below. Home Buyers cannot use gift funds for reserves that are required by lenders.

Free attendance at a widely attended gathering Discounts and similar opportunities and benefits available to all Government employees. In order to establish whether a particular gift of down payment money is permitted we have to examine what the FHA describes as a bona fide gift. At least 35 of your down payment needs to be your own money if your credit score is between 580 and 619.

However the FHA program allows you to obtain the downpayment through a gift. The seller is allowed to pay up to 6 of the sales price toward the home-buyers closing costs and prepaid expenses ie. This gives the buyer instant equity of 130000.

For example if the borrowers verified checking account reflects a balance of 15000 and 5000 of that amount was from a gift the checking account balance should be adjusted to reflect 10000 and the 5000 should be entered separately as a gift. This could mean that buyers essentially can purchase a home with no cash down payment thanks to the sellers discount. The portion of the gift not used to meet closing requirements may be counted as reserves.

Will apply interested party contribution limits to the gift amount. FHA only allows when real estate agent who is also eligible donor gifts commission from the transaction to borrower. The upfront MIP will be 175 percent of the base loan amount in 2022.

If you are applying for a FHA loan the FHA Certification section must be signed by both the gift donor and the recipient acknowledging the warning stated in that section. The FHA Federal Housing Administration is the easiest path to homeownership. FHA will not apply interested party contribution limits to the gift.

What does this mean. Thats more than enough to cover a down payment of 35 percent which is required by the FHA. If you get a 350000 house loan for example youll pay an upfront MIP of 175 percent x.

The federal housing administration fha insures home loans made to borrowers of modest means. Most home buyers who use FHA come up with at least 35 percent down from their own funds. FHA guidelines for gift funds.

There are strict rules and regulations with FHA Guidelines On Gift Funds Mortgage Requirements. Gift funds are commonly used for home loan expenses including down payments but when the borrower accepts gift funds for the purpose of making that down payment the funds must meet FHA acceptability standards.

Fha Down Payment And Gift Rules Still Apply

Louisville Kentucky Mortgage Lender For Fha Va Khc Usda And Rural Housing Kentucky Mortgages Using Gift Money For A Down Payment In Kentucky For A Mortgage Loan

Fha Gift Funds Guidelines 2022 Fha Lenders

Fha Gift Funds Guidelines 2022 Fha Lenders

Louisville Kentucky Mortgage Lender For Fha Va Khc Usda And Rural Housing Kentucky Mortgages Using Gift Money For A Down Payment In Kentucky For A Mortgage Loan

Closing Costs And Gift Limits Arizona Mortgage House Team

Can I Use Gift Money For My Fha Home Loan Down Payment Fha News And Views

Fha Gift Funds How Can I Use Them To Buy A Home

2022 How To Use Gift Funds For Fha Loan Closing Costs Fha Co